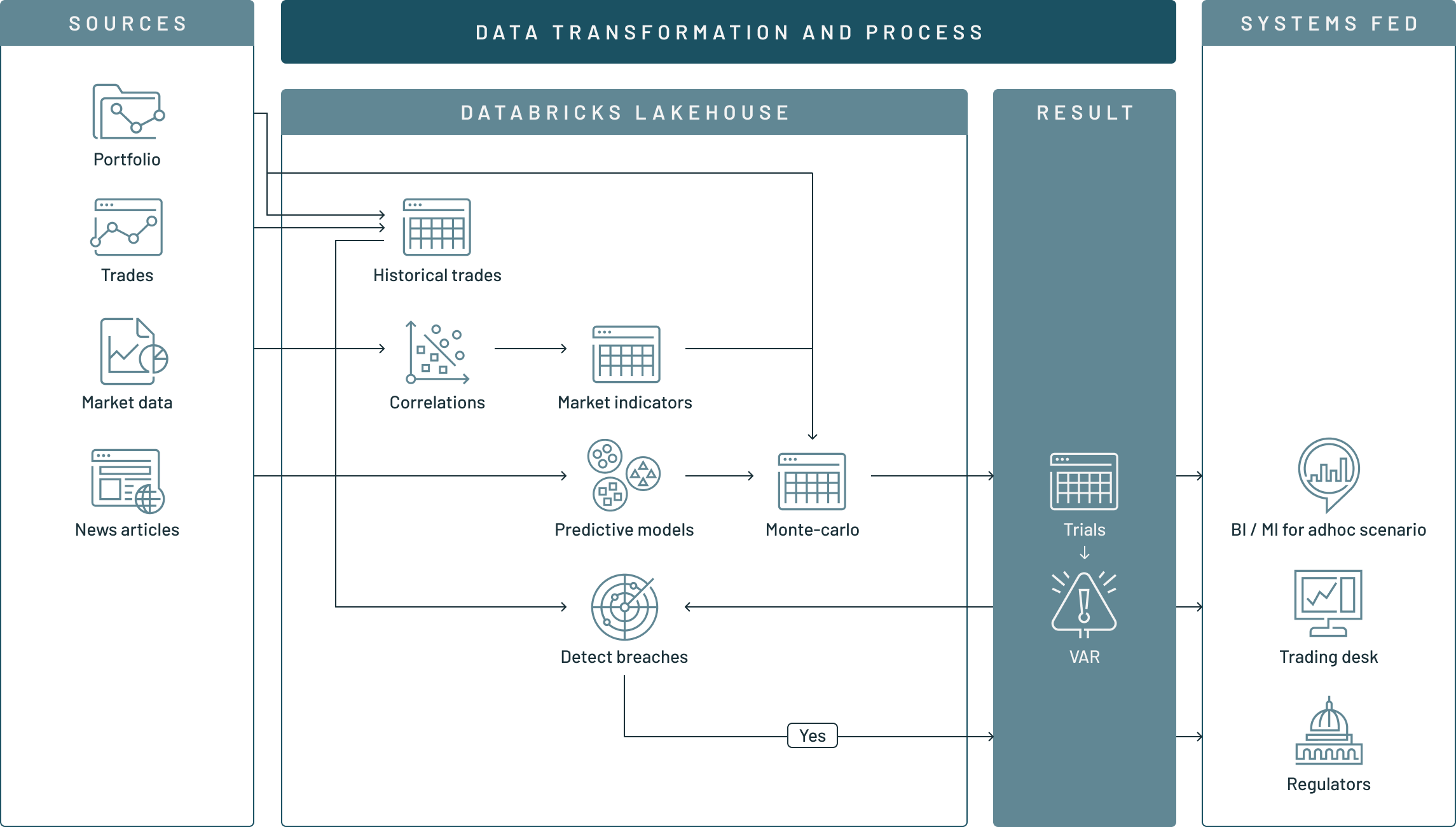

Adopt a more agile approach to risk management by unifying data and AI in the Lakehouse

This solution has two parts. First, it shows how Delta Lake and MLflow can be used for value-at-risk calculations – showing how banks can modernize their risk management practices by back-testing, aggregating and scaling simulations by using a unified approach to data analytics with the Lakehouse. Secondly. the solution uses alternative data to move towards a more holistic, agile and forward looking approach to risk management and investments.

Read the full writeup part 1→

Read the full writeup part 2→

Download the VaR and Risk Management Notebooks:

Benefits and business value

Gain a holistic view

Use a more complete view of risk and investment with real-time and alternative data that can be analyzed on-demand

Detect emerging threats

Proactively identify emerging threats to protect capital and optimize exposures

Achieve Speed at Scale

Scan through large volumes of data quickly and thoroughly to respond in time and reduce risk